In today’s fast-paced financial services landscape, risk and regulatory compliance programs have become more than just a necessity—they are a critical lifeline for companies navigating the complexities of the industry. But designing, improving, and maintaining these programs is no small feat – it can be complex and time-consuming. It requires a delicate balancing act of collecting and analyzing vast amounts of data from various sources, while also staying ahead of the curve in complying with ever-changing rules and regulations from multiple authorities.

And recently, the rapid emergence of Artificial Intelligence (AI) has added a new layer of complexity to the mix for compliance program leaders. With an influx of guideline proposals, reports, and speeches, it’s clear that U.S. federal regulators are laser-focused on the growing role of AI within risk and compliance—especially in the financial services sector.

The stakes have never been higher for financial services companies to not only keep up with the breakneck pace of change but also to proactively embrace innovative solutions that can help them stay one step ahead of the game.

If you’re a leader in financial services, you’ve come to the right place. In the following blog, we offer strategies for capitalizing on the capabilities enabled by AI to bolster your compliance programs.

Creating possibilities with AI

It’s true: AI presents a brand-new set of challenges for your organization. We’ll uncover those a bit later. But it also unlocks unprecedented potential for risk and compliance leaders in the financial services industry.

leaders in the financial services industry.

First, AI has the potential to transform your risk and regulatory compliance efforts by automating repeatable tasks, enhancing data accuracy, and supplying objective insights.

Second, it can help you design controls that enhance compliance frameworks and mitigate risks. Not only does this improve efficiency, but it can significantly drive down your costs.

And third, AI can generate documentation for your controls, which will help regulators see the tangible benefits of AI in enhancing your risk and compliance efforts.

And once you’ve successfully adopted AI,  your compliance leaders will also be better equipped to:

your compliance leaders will also be better equipped to:

- Reduce costs and drive revenue by increasing productivity, scalability, and efficiency—regardless of unexpected workforce changes.

- Strengthen risk mitigation by improving the ability to recognize threats and identify their corresponding mitigating controls.

- Enhance compliance assurance by easing data collection and integration, simplifying and standardizing reporting, and providing auditable records.

- Boost competitive advantage by empowering compliance professionals with resources that enable innovation, differentiation, and identification of new opportunities for products and services.

Four ways to use AI in your compliance program

From data management to decision making, AI has the power to transform the way your financial services firm executes risk management. Here are four need-to-know use cases for financial services leaders like yourself:

Advancing data management. AI can help you collect, integrate, and standardize data from multiple sources—think internal systems, external databases, and third-party providers. The technology is also designed to spot anomalies in data that require additional review, enhancing the quality of your data sets.

Streamlining analytics and reporting. By applying advanced techniques such as machine learning (ML) and natural language processing (NLP), AI is primed to transform data analytics in your compliance program. These techniques can help automate and streamline your reporting processes by generating natural language summaries and dashboards.

Detecting risk faster. AI revolutionizes risk monitoring in the financial services space. Through anomaly detection and pattern recognition, AI can swiftly identify common threats such as fraud, money laundering, cyberattacks, and potential fair lending violations. By leveraging AI to enhance surveillance, compliance leaders can prioritize alerts, provide evidence and explanations, and recommend actions within their specific model, ultimately strengthening their risk management capabilities.

Optimizing insight-backed decision making and processes. AI can help business leaders make more informed, faster decisions through predictive analytics. By analyzing large amounts of data, AI forecasts potential outcomes and provides valuable insights to help you navigate decision-making processes. It also streamlines risk and regulatory compliance processes by pinpointing redundancies and inefficiencies in ways of working and suggesting improvements.

Challenges of AI adoption for risk and regulatory compliance & tips for overcoming them

Although AI can offer immense value, you must also be aware of the challenges posed by AI adoption. Understanding the following common obstacles ahead of time will better prepare you for the AI-journey.

AI relies on large amounts of data to effectively learn and validate models. Some financial services companies may face data limitations such as data scarcity, fragmentation, inconsistency, and data ownership issues.

One of the first steps toward ensuring data quality is defining and aligning your AI strategy and vision with these three actions:

- Assessing your current state for all data-related processes so you can identify weak spots and implement best practices where they’re needed most.

- Identifying your goals and objectives to ensure that the data you are collecting and using is relevant and trustworthy.

- Developing a roadmap and action plan to inform current data processes as well as future needs.

Models using AI may be complex, opaque, and non-intuitive. This can make it difficult for compliance team members (and others who are privy to this information) to understand how the models work, why they produce certain outputs, and how they can be trusted and verified, especially for high-stakes and high-impact decisions.

There are two primary methods for achieving model transparency:

First: Outline your AI-journey business case and value proposition to measure ROI, highlight success stories, and outline best practices. This will help garner buy-in and foster trust in your organization’s model.

Second: Engage an outside partner to support the design and implementation of your specific solution. This will give you access to the targeted expertise your program needs for integrating technologies, tools, and platforms, as well as testing your AI models—without making permanent workforce changes.

Using AI may introduce new risks and uncertainties to existing challenges, such as bias or discrimination, thereby violating existing rules and regulations, like the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA). Regulators recently spoke at the Responsible AI Symposium and reiterated that existing regulations are technology-agnostic.

Leaning into proactivity is a powerful strategy for overcoming regulatory uncertainty. Help your compliance program members embrace change by providing critical knowledge resources—like training and education—that drive awareness of potential or upcoming regulatory changes.

The use of AI may uncover the need for significant changes in your organizational structure, processes, and culture. This will likely include new roles, skills, capabilities, ways of working and collaborating, and mindsets and attitudes.

Organizational readiness and a strong culture of compliance are essential for successfully navigating the complexities of risk and regulatory compliance. To achieve this, it’s crucial to take a people-centric approach that prioritizes the development and empowerment of your workforce. One key aspect of this is supplying your teams with training and educational resources. In addition to boosting proactivity, doing so will equip your people with mission-critical skills and capabilities. Plus, adopting a people-centric approach is vital for fostering engagement with AI and guiding your workforce through the inevitable transformation that accompany this technology.

Have you planned your next step?

To fully harness the transformative potential of AI in your compliance program, you need a holistic strategy that goes beyond the tips we’ve shared here. While these recommendations provide a solid starting point, getting the most value out of your AI investments requires an approach that prioritizes people, embraces change, and adapts to your unique challenges and opportunities.

change, and adapts to your unique challenges and opportunities.

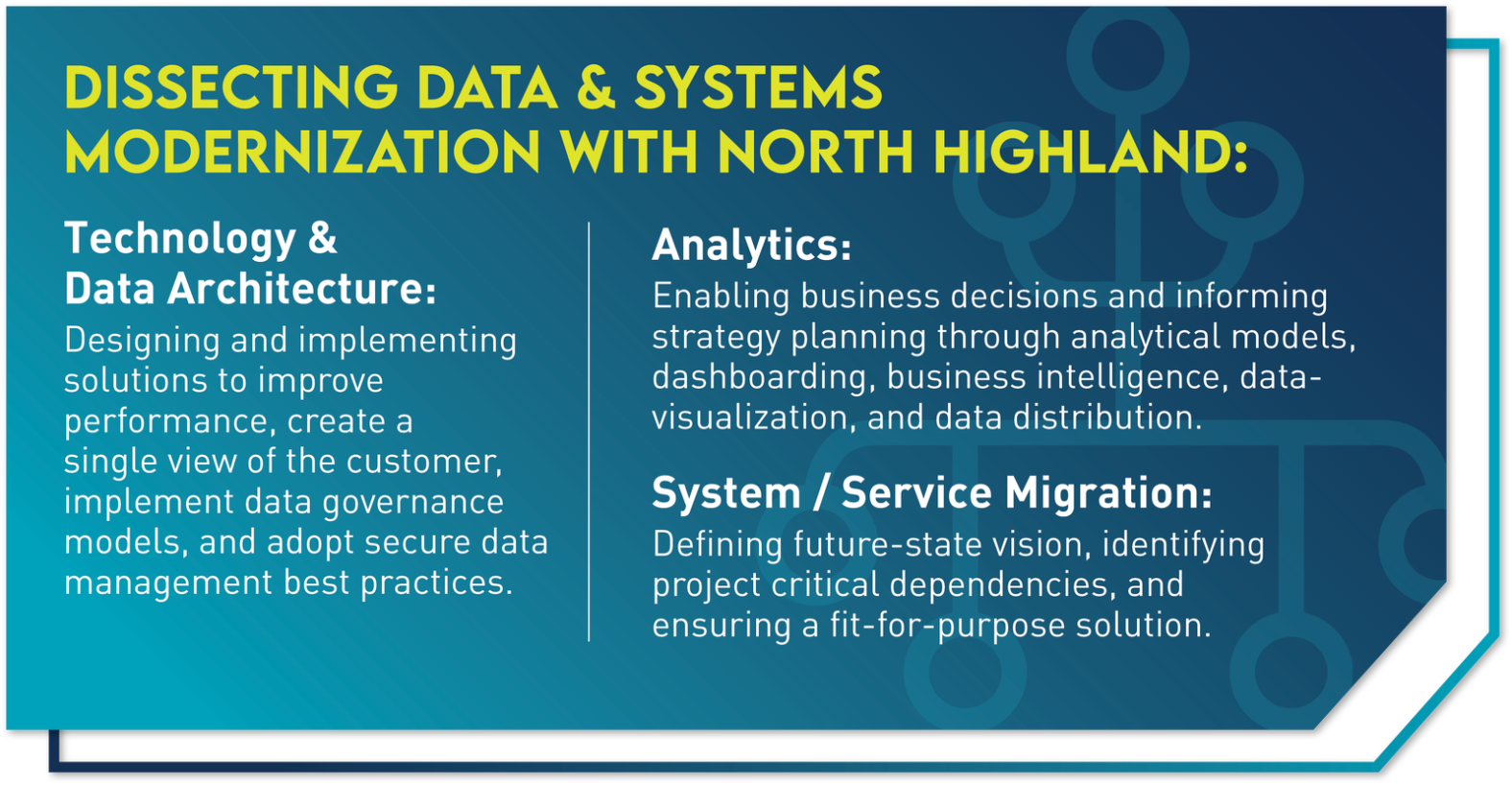

North Highland provides end-to-end guidance to help financial services firms navigate the intricacies of AI adoption and unlock the full value of AI for compliance programs. Our team of experts works closely with leaders to assess their current compliance landscape, identify where AI can drive the most impact, and develop a tailored roadmap that aligns with specific goals and requirements. You can learn more here.